Entering A/R Payments and JEs

JE = Journal Entry = Journal Entry Credit or Journal Entry Debit

Accounts Receivable invoices and applications(JEs) are stored in the ARDET file. This routine is used most often to enter payments received from Investors. It is easier if you have a recent Accounts Receivable Inquiry report for reference.

MAKE PAYMENTS ONE AT A TIME

Select A/R - Invoice - Payments and JE's

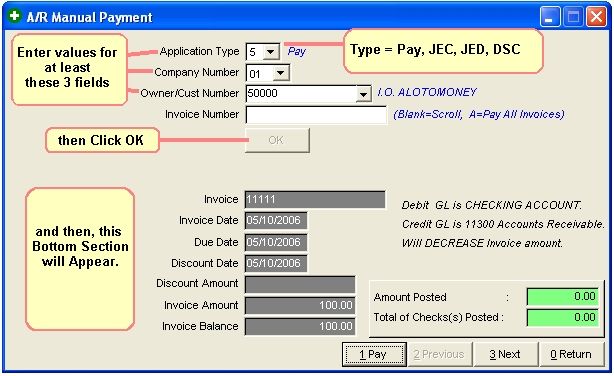

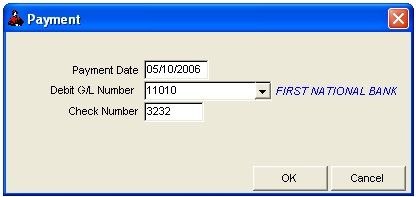

CHOOSE ONE OR ALL INVOICES

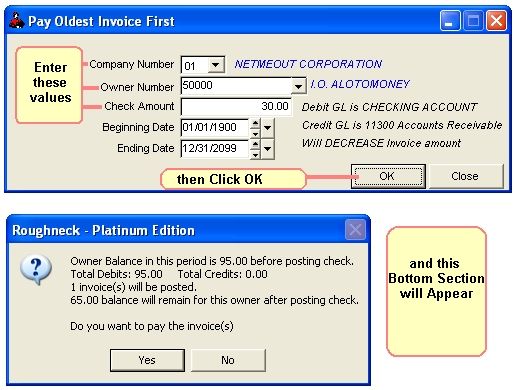

This option is used to pay or post a journal entry application to each individual invoice number. Also used to scroll invoices or pay all invoices for an owner. To Scroll through all invoices for an owner, leave the invoice number field blank. Scrolling will display the first invoice on file for the owner specified and ask if you want to make an application or skip to the next invoice. The Pay All invoices option is only available for Payment applications. To pay all invoices of an owner, enter A=Pay All invoices. Entering A, will display the total amount due for the owner. If you say 'Yes', pay ALL invoices for the FULL amount, you will be asked for the payment date, debit general ledger number, normally your checking account and check number.

The debit is to your checking account. A credit is automatically made to 11300, Accounts Receivable. A credit will decrease Accounts Receivable balance. A debit to your checking account will increase the bank balance. When you select next invoice, the invoice amount and balance is displayed, you may enter payment, skip this invoice or select exit.

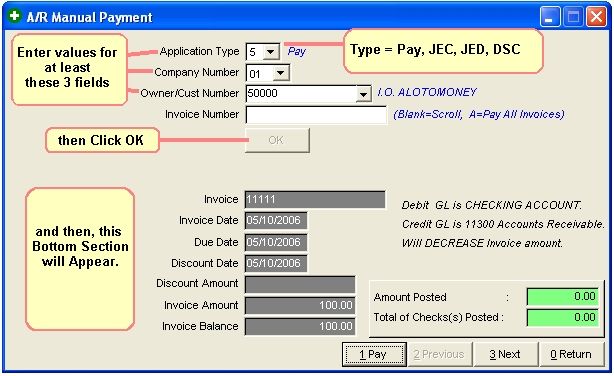

PAY OLDEST INVOICES FIRST

When an owner sends a check amount that is to be applied to all of his outstanding invoices, by the oldest invoice date, you will use this option. All invoices will be checked for this owner to determine what the owner's balance is for all invoices before posting the check amount you specified. You will be flagged the number of invoices this check amount will pay. You will be told what the remaining balance will be for this owner after posting this check amount.

Select A/R - Invoices - Pay Oldest First

Invoices will be paid based on the beginning and ending invoice date specified in filter. Always print a current Accounts Receivable Inquiry report to check invoice amounts and dates of invoices prior to posting check amount. Any partial amount remaining of the check amount will be applied automatically to the latest invoice

Click Yes.

Complete the fields.

Click OK.

FILES UPDATED WHEN PAYING ACCOUNTS RECEIVABLE INVOICES

ARDET - The Application itself is stored here, and the invoice Balance is reduced or increased by the amount of the Application. (Payments reduce the invoice Balance)

ARREG - The Posting Register for Accounts Receivable. A record is added to reflect the application made.

TRAN - A credit or debit is made to Accounts Receivable (general ledger number 11300) and a credit or debit is made to the general ledger number you specify. For a normal payment: Accounts Receivable is credited, and the cash account you specify is debited.

CUST - The year to date balances are updated.

BANK - The Bank Reconciliation file will be updated for deposits/checks to cash account.

NOTES ON FILTER FIELDS FOR PAYING ACCOUNTS RECEIVABLE INVOICES

APPLICATION TYPE: Invoices can have 4 different types of applications. The applications are stored in the file as numbers (3=JEC, 5=PAY, 6=JED, 7=DSC). For example, if you wanted to enter a payment, use application type 5.

COMPANY NUMBER: The Company this invoice will be assigned to.

OWNER/CUSTOMER NUMBER: The owner or customer this invoice will be assigned to.

INVOICE NUMBER (Blank=Scroll, A=All or Number): You can enter a specific invoice number and only that invoice will be accessed. To Scroll through all invoices for an owner, leave the invoice number field blank. Scrolling will display the first invoice on file for the owner and ask if you want to make an application or skip to the next invoice. The A=Pay All invoices option is only available for Payments. To pay all invoices of an owner, enter A. Entering A, will display the total amount due for the owner, and ask if you want to pay all invoices.

ACCOUNTS RECEIVABLE JOURNAL ENTRY DEBIT

The credit general ledger number is usually the JIB OFFSET account (GL number 76320 of the sample data - see GL Number Restrictions) for invoices automatically added from the Operating Statement update. However, if the invoice was entered through Add in the Accounts Receivable Programs, you should credit the general ledger number that was credited there (usually that is a cash account). In other words, credit whatever was debited when the invoice was entered.

Roughneck Help System 02/15/07 10:30 am Copyright © 2006, Roughneck Systems Inc.